When you decide you’re going to become a Virtual Assistant and take over the Universe, one of the things you’ll need to do is tell HMRC you’re no longer working for The Man but for many men and women instead. The information provided below is based on current UK tax laws, so please check what your own government requires if you live outside of the UK.

* This post was last updated on the 7th of April 2025.

Because most UK Virtual Assistants are sole traders rather than limited companies (and because this post would be so long you’d still be reading it at Christmas), the majority of the post focuses on tax and National Insurance (NI) for sole traders only.

Below you will find FAQs about UK tax and NI. information along with some other info and a list of useful resources.

Should I set up as a sole trader or a limited company?

Great question. There are a few differences between the two, but the main one is that when you are a sole trader, any business debts are your debts and any personal assets – including your house if you own it – are not protected if someone decides to sue you.

I’m not sure what you could possibly do that would result in a client suing you, but you have a contract and insurance in place to prevent this from happening.

When it comes to limited companies, the structure is different, tax thresholds and payments are different, how you pay yourself is different, and any debts belong to the company and not you as an individual.

You also need to register your business with Companies House, which you do not need to do if you are a sole trader.

Incorporating and submitting your tax returns is also more complicated for limited companies. I was advised to become a limited company after I bought a property, but I was a sole trader prior to that.

I personally think it was easier being a sole trader as I now have to rely on my Accountant to help me and I still find it hard to get my head around the whole concept of dividends and corporation tax!

- You can find more info from HMRC on running a limited company here.

- This article explains all the differences between sole traders and limited companies in the UK.

How do I register as a sole trader?

In the UK, when you start working for yourself, you need to let HMRC know your situation has changed so they can update their records.

You do this by going online and registering for self-assessment and National Insurance (NI) contributions.

HMRC will then send you a Unique taxpayer reference (UTR) in the post within six weeks.

What’s the Unique Tax Reference for?

Your UTR is really important and is used to submit your online tax return.

After you register for self-assessment, you’ll receive a letter containing your UTR and an activation code so you can sign up for the Government Gateway website and submit your tax return.

IMPORTANT – It can take a few weeks to receive your UTR, so register ASAP to allow plenty of time to receive it before you have to submit your online tax return before the 31st of January deadline.

When do I need to tell HMRC I’m earning money as a freelancer?

You need to register as a sole trader with HMRC and submit a self-assessment tax return as soon as you earn more than £1,000 from self-employed work during the tax year, even if your employer is still paying you.

Current tax rates and allowances

How much income tax you pay in each tax year depends on:

- How much of your income is above your Personal Allowance.

- How much of this income falls within each tax band.

Personal Allowance: the 2025/26 Personal Allowance (the amount you can earn before you have to pay tax on it) is £12,570.

Your Personal Allowance may be higher if you claim a Marriage Allowance or a Blind Person’s Allowance and smaller if your income is over £100,000.

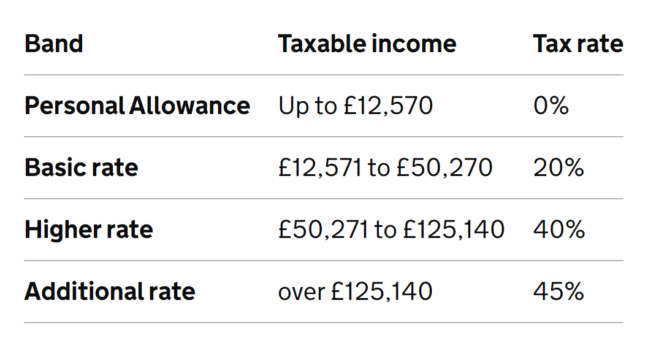

Income tax rates and bands (2025/26)

The table below shows the tax rates you pay in each band if you have a standard Personal Allowance of £12,570.

This screenshot of figures was taken from the HMRC income tax rates page which contains other links you will find useful.

You have tax-free allowances for:

- Savings interest.

- Dividend income if you own shares in a company.

- Your first £1,000 of income from self-employment – this is your ‘trading allowance’.

- Your first £1,000 of income from property you rent (unless you’re using the Rent a Room Scheme).

So you pay tax on any interest, dividends or income over your allowances.

Income bands and rates are different in Scotland.

National Insurance Contributions (NIC)

The class of National Insurance you pay depends on your profits, which are calculated by deducting your expenses from your self-employed income.

You pay Class 4 contributions if your profits are more than £12,570 a year.

For the 2025 to 2026 tax year, you’ll pay:

- 6% on profits between £12,570 and £50,270

- 2% on profits over £50,270

Registering with HMRC as self-employed covers income tax and national insurance, so your NIC is calculated and paid in one go when you make your self-assessment tax return.

Read more about National Insurance on the HMRC website.

Check how much you have paid in National Insurance Contributions.

How much money should I put aside for tax?

The general rule of thumb is to put aside 30% of your earnings for your tax bill. This should be slightly more than you need so you won’t have to worry about not having enough.

The best way to think of it is, “For every £100, I’m paid £30 of it isn’t mine.”

You will have a problem if you can’t afford to put aside 30% because that money isn’t yours; it’s the taxman’s

What financial records do I need to keep?

In the UK, it is a legal requirement to keep business records as evidence of income and expenditures each tax year.

You must keep records of:

- All sales and income

- All business expense receipts

- VAT records (if you’re VAT registered)

- PAYE records if you employ people

- Records about any personal income

- Cash books

- Invoices

- Mileage records

- Bank statements and chequebook stubs

- Your P60s if you’re also employed

When it comes to your tax return, you will also need to submit other information, such as how much you have invested in your business and any money you have invoiced for but have not yet paid.

Read more about the business records you need to keep.

How should I keep my financial records?

You should keep your records either on paper or on your computer. For electronic records, you must:

- Capture both sides of a document

- Save all information in a readable format

- Keep a back-up

Most Virtual Assistants use an accounting platform, though, because this isn’t the Dark Ages.

I use Xero, but as there are many others out there, I post regular polls in the Facebook group, asking members which platform they use to keep track of the most popular ones.

How long do I keep my financial records?

You need to keep business records and receipts for at least five years after the 31st January submission deadline of the relevant tax year.

Example: if you submitted your 2023 to 2024 tax return online by 31st January 2025, you must keep your records until at least the end of January 2030.

What happens if I lose an expense receipt?

If you don’t have a receipt for a cash expense, then just make a brief note of the amount you spent when you bought it and what it was for.

What happens if my records are lost, stolen or destroyed?

If you cannot replace your records, you must do your best to provide figures. Tell HMRC when you file your tax return if you’re using:

- Estimated figures – your best guess when you cannot provide the actual figures.

- Provisional figures – your temporary estimated figures while you wait for actual figures (you’ll also need to submit actual figures when available).

How do I complete my self-assessment tax return?

Once you’ve registered for self-assessment, HMRC will contact you when it’s time to submit your tax return. I don’t know anyone who files a paper tax return, so you will probably be filing your tax return online.

The UK financial year runs from 6th April one year to 5th April the next year, and you submit figures for the previous tax year.

So, in October 2025 (if filing a paper return) or January 2026 (if filing an online return), you’re submitting your income and expenditure for the period between the 6th of April 2024 to the 5th of April 2025.

It’s difficult to explain exactly how to complete your tax return because your answers will depend on your personal financial situation, including income from other sources (property rental, dividends, benefits, etc.), savings, and any investments you may have.

It’s also important to note that you have to complete a self-assessment tax return even if you do not owe any money. Failure to do so may result in a penalty fine.

Can I do my own tax return?

My accountant does my tax return as I’m a limited company, but I submitted my own tax return when I was a sole trader.

It’s not massively hard, but it’s not particularly enjoyable!

When I did my own tax return, I felt very anxious in case I messed it up. So even though I have to pay my accountant, I like the fact that it’s all taken care of by an expert.

My Accountant also provides a lot of additional value by advising me on ways to save money, helping me stay tax-efficient and being there to answer any questions I may have.

You could do your own return (and many weirdo VAs actually enjoy doing it), but you may decide to use an Accountant for peace of mind.

What happens if I miss the tax deadline?

The deadline for submitting your online self-assessment tax return is January 31st, and penalties for late filing include an automatic fixed penalty of £100 if your return is up to three months late.

If your return is more than three months late, additional penalties will apply, so if you receive a letter from HMRC telling you to file your tax return, you must do so even if you don’t owe them anything.

What if I can’t pay all of my tax bill?

If you cannot pay your tax bill in full, you may be able to set up a payment plan to pay it in instalments. This is called a ‘Time to Pay’ arrangement.

You will not be able to set up a payment plan if HMRC does not think you will keep up with the repayments. If HMRC cannot agree a payment plan with you, they’ll ask you to pay the amount you owe in full.

Read more about Time to Pay here.

Can I submit my tax return early?

You can actually file your tax return for the previous tax year any time after the beginning of the new tax year.

This means you can file your 2025-26 Self Assessment tax return any time between the 6th of April 2025 and the 31st of January 2026 if you want to get ahead.

There are a few benefits of submitting your tax return early:

- Payments on Account (outlined below) are future payments towards your next tax bill, which have been calculated based on your previous one. But if you submit your tax return early, you have a heads-up on how much your bill will actually be so you can plan your finances.

- If you’ve overpaid tax, you should get a refund sooner.

- Knowing in advance how much your tax bill will be allows you to plan your finances and set money aside.

- If you’re not sure if you can pay your tax bill in one go and may need HMRC’s Time to Pay payment plan, you can only do so if you have already submitted your tax return.

You have to pay ahead (payment on account)

You may not be aware of this, but you also have to pay a percentage of the next year’s tax and National Insurance in advance. This is in addition to the tax you paid for the previous tax year.

Many freelancers get caught out by this.

HMRC take one Payment on Account at the end of January and the other at the end of July. These are a combo of advance tax and National Insurance payments towards your tax bill.

Each payment is half of your previous year’s tax bill, and payments are due by midnight on 31st January and 31st July.

You have to make two payments on account every year unless:

- Your last self-assessment tax bill was less than £1,000.

- You’ve already paid more than 80% of all the tax you owe, for example, through your tax code or because your bank has already deducted interest on your savings.

If you still have tax to pay after you’ve made your payments on account, you must make a ‘Balancing Payment’ by midnight on 31st January next year.

Here is more info on Payment on Account, including examples.

VAT

VAT (Value Added Tax) is a tax added to most products and services sold by VAT-registered businesses.

You must register for VAT if your annual turnover is more than £90,000.

You can also choose to register if your turnover is less than £90,000 if you want to reclaim VAT on items you buy for your business.

It’s unlikely you will want or need to be VAT-registered, but if you’re not sure what registering will mean for your business, you can check out the HMRC VAT registration estimator here.

Also, if you decide to become VAT registered, I suggest hiring an Accountant because the whole thing is a massive ballache!

Making Tax Digital (MTD)

Under MTD, self-employed people will be able to send HMRC summaries of their income and expenditure at least four times a year and submit quarterly tax returns through online accounting platforms such as Xero, QuickBooks, Sage, FreeAgent, etc.

HMRC says this will enable a more ongoing and accurate projection of tax due, as opposed to the current system of one tax bill every year.

I personally think MTD is a good idea because it will allow you to make a more accurate financial forecast.

Although the UK government says that MTD won’t happen until at least April 2026 (they’ve already moved this date back a few times now), it’s worth knowing what it is so you’re prepared.

You need to follow the requirements for Making Tax Digital for Income Tax if you are self-employed or a landlord from:

- 6 April 2026 if you have an annual business or property income of more than £50,000

- April 2027 if you have an annual business or property income of more than £30,000

You can read an overview of Making Tax Digital here.

Key dates and deadlines

As mentioned, the UK tax year runs from April 6th to April 5th, so your accounts need to be calculated from and to these dates. We are currently in the 2025/2026 tax year.

HMRC key dates for the self-employed.

- 31st of January – the deadline for filing an ONLINE self-assessment tax return, the first Payment on Account payment, and any Balancing Payments. National insurance contributions are calculated and paid automatically when you submit your return.

- 31st of July – the deadline for paying your second Tax on Account instalment.

- 5th of October – newly self-employed people need to register with HMRC for self-assessment by this date so they know you will need to complete a tax return next year. If you’ve already registered as self-employed, you don’t need to do this again.

- 30th of October – the deadline for submitting a PAPER tax return. National insurance contributions are calculated and paid automatically when you submit your return.

- 30th of December – the date that if you’re also employed, you can choose to pay any tax due through your PAYE code instead of making a big payment on the 31st of January. (But only if you submit your tax return before 30th December.)

How’s your head doing? Exploded yet?

Takeaways

As you can see, UK tax laws are a complete ballache, and things like personal allowances and NI rates usually change each financial year.

You need to make sure you stay on top of this stuff because HMRC are serious folk, and they do not take ignorance as an excuse.

Always check with HMRC if you’re unsure about anything or pay an Accountant to ensure compliance.

I update this post on the 6th of April every year to reflect any changes, and I always make sure the post is up to date if any major changes are made that will affect self-employed people.

Resources

- All the information and advice you need can be found in the Self Employment section of the HMRC website.

- For ease, this HMRC guide to self-assessment for the self-employed is another good summary of how it all works.

- Here is the HMRC tool for budgeting your self-assessment tax bill. Simply enter your estimated weekly or monthly profit to get an idea of how much tax and National Insurance you’ll pay.

- Here is another personal tax calculator you may find useful.

- Subscribe to HMRC’s YouTube channel. They also have many handy videos on submitting your return.

- Sign up for free HMRC e-learning, webinars, emails and videos here.

- Here’s the HMRC page outlining the business records they want you to keep.

- Here’s an HMRC article outlining what you can claim under business expenses.

Disclaimer: I am not an Accountant and take no responsibility for the financial information published on this page. While I have obtained this information from official sources, please always confer directly with HMRC or a qualified Accountant.

|

Looking for legal contracts?Whether it’s a client contract, a DPA or website policies, you need to have the legal stuff in place so you don’t get sued or screwed. Written by an international contracts lawyer specifically for VAs, all the docs are updated and resent to buyers free of charge whenever the law changes.. |

Hi Jo, thanks for this. I’ve literally just submitted my tax return and i got totally caught out by the awful payment on account system. I had no idea about this and got a big shock. Should have read your blog post! Nightmare.

On NI contributions, you say ‘In addition to registering with HMRC for tax, self-employed people in the UK pay one of two types of NIC’. I had to pay both class 2 and class 4 contributions. They couldn’t give me a good reason for this.

Anyway thank you as always for helpful content.

Hello! I’m loving you blog, you have so many useful tips! But I do have a question: If I register as a sole trader only when I start to earn money, will I still be able to put on the expenses the things I adquired to start my business in the first place (like a laptop)?

Thank you! Yes, you can legitimately offset any pre-startup expenses against your turnover once the business has started trading, as long as such expenses were incurred within 7 years of the first day of business (as per s.61 of the Corporation Tax Act 2009). You can Google for more information but always secure your tax information from HMRC or a qualified accountant, though.

Thanks so much for sharing all this information. As a newbie to being self employed, it’s pretty overwhelming but I’ll be book marking this blog post for future reference 🙂

Hi,

At what stage do I register my company? Straightaway or once I have my first client?

Hi Charlene, in the UK you only need to register a company if you are a Limited Company and you do this with Companies House. If you are just a Sole Trader (most freelancers are), you only need to register for Self Assessment once you start earning money. All the links are in the post and your first port of call should be the HMRC website. They have some great articles and are really helpful.

Hi Alex the START HERE page has a list of every post.

Hi!

Loving your site, it’s full of useful tips!

I am a contractor (in project management as a PMO) and looking to become a VA – I already have a limited company, so could I just use this instead of becoming a sole trader?

You can indeed. I would speak to an Accountant though as you may need to inform HMRC that the nature of your business has changed.

Hi

Looking to start work in the virtual world. Would I still be able to claim for the purchase of a vehicle, even though I work at home? I know I can say I am out buying replacement paperclips, or visiting potential clients even, but would HMRC stand for this?

Thanks

Murray

I don’t think so but I WISH it was so! It has to be something you ONLY use and need for work. I would ask HMRC directly as I’m not an expert in this I’m afraid. x

Hello!

I would like to approach the world of VA and become one.

At the beginning I want also to keep my pwrt time employment, you know, just to not have too much pressure.

Do you think it’s possible to have both employed and self-employed works? And if so, how can I work out taxes and NI?

Thank you for your help.

Isa

Hi Isa, if you’re in the UK, you need to tell HMRC as soon as you start earning any money. You will do an annual online Self Assessment (you need to get your Unique Tax Reference first) and when it comes to the bit about earnings you complete how much you made as a Freelancer as well as your employment status. You can find details online by doing a Google search.

Although I know a little about this (I completed my first self assessment this way) I am not a legal expert and you should always take expert advice in all financial matters. My advice is to call HMRC and ask them what you need to do.

P.s. Just to clarify, the “company” is a UK Virtual PA company, so they have the client base etc, and there is “virtual” office here where most of the PA’s work from in order to share tips and talk things through if needed. So it is a company, rather than setting up my own. It’s not totally home based, which for me is better. Thank you!

Hi Kate, I’ll be honest in that I have absolutely NO idea! I don’t want to give you false information so I would recommend asking on the VA Handbookers Facebook group as well as checking with HMRC (or equivalent) etc.

I think if you’re working Digital Nomad style then you pay tax in whichever country you’re registered in but I would always check anything legal with a financial and/or legal professional to cover yourself.

Hi, I have found your website incredibly helpful. Thank you. I have worked across Europe and recently moved back from working in Singapore. I am now based in Cape Town and want to work as a Virtual EA. There is a company that is based in the UK but operates out of Cape Town (far cheaper which can of course be passed on to clients, plus only 1 hour time difference from the UK). However I’m unsure as to the tax/legal situation of being on a UK contract, but working out of a different country. Any suggestions or guidance? Thank you so much! Kate

I am looking to become a VA and have been researching how I can set myself up. I am currently living in France, as we moved here 18months ago with my husband’s work and will be returning to the UK in the future. Can I set up a UK business when I am not living in the UK? And do you think this would limit my success as I will find it hard to meet with clients face to face and be out of the country ?

Hi Gemma, I don’t actually know the answer to the first part f that question but HMRC or one of the VA’s on one of the VA LinkedIn groups might be able to help. With regards to meeting clients whilst out of the country, that is what Skype or Google Hangouts is great for.

I have a client who lives in France who I do events with and he does all of his work with Skype and Hangouts. He lives in the middle of nowhere and says his Internet connection is far quicker and stronger there than here. He does come to the UK now and again to meet clients and just puts the trip on his expenses – the great thing about France is that they’re an hour ahead, so when you come to the UK you arrive pretty much the same time you left!

I have clients I’ve never met and the whole point of being virtual is so you can work from anywhere in the world. I often work from a holiday destination and my clients have no idea where I am – nor do they care as long as I get their work done on time. If you have a reliable way of communicating then you can be wherever you like! x